Get Your ERC Payment Now

Receive up to $26,000 per employee. Claim Your

2022 Employee Retention Credit.

Get Your ERC Payment Now

Receive up to $26,000 per employee. Claim Your

2022 Employee Retention Credit.

The #1 Rated ERC Firm

ERC is a free stimulus program from the US Government (CARES Act)

Average refund is $200k per application. No limit on funding.

Our expert firm specializes in the ERC filing process.

Qualify for ERC in just 5 minutes & speak to an expert advisor.

We make it easy and handle the whole ERC process for you.

ERC is a grant - not a loan. No need to pay it back.

No Up Front Fees. No Credit Check. No Risk.

Get money from the IRS, even if you already received PPP.

What are business owners saying?

Real reviews from Google Reviews

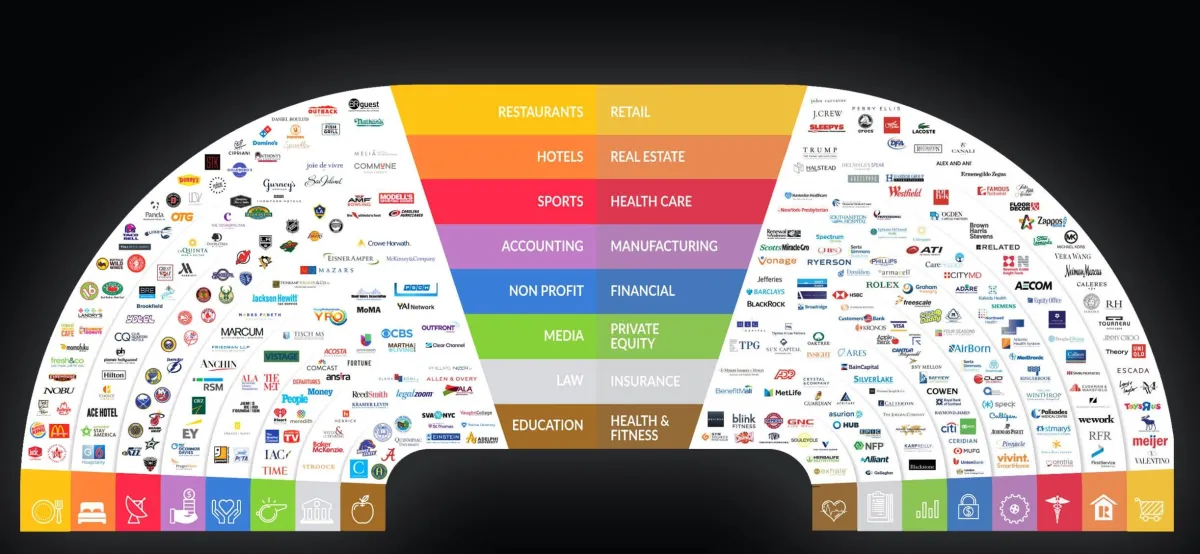

16,000 Clients Trust Us

No matter how big or small, we've got you covered.

Watch this Quick ERC Explainer Video

We'll get your ERC in a few easy steps.

1. Speak to one of our Expert Advisors

Schedule a call with one of our friendly experts. We'll ask you some simple questions to ensure you qualify for ERC.

2. We'll do all the work for you

We'll work together to collect the necessary paperwork. Then we'll prepare your entire ERC filing to submit to the IRS.RC.

3. Get a Check from the IRS

We'll get you a check for the maximum ERC amount that your business can qualify for. We've done it for many!

About the ERC Program

What is the Employee Retention Credit?

ERC is a government stimulus aid program designed to help those businesses that were able to retain their employees during the Covid-19 pandemic.

Established by the CARES Act, it is a refundable tax credit – a grant, not a loan – that you can claim for your business. The ERC is available to both small and mid-sized businesses. It is based on qualified wages and healthcare paid to employees.

Up to $26,000 per W2 employee

Qualify with a change in business operations

Qualify with decreased revenue

Available for 2020 and the first 3 quarters of 2021

No limit on funding

ERC is a refundable tax credit, not a loan

Qualify for ERC even if you already received PPP

What We've Done

We are ERC Experts and have helped thousands of businesses

$3

Billion in refunds

16K

Happy Clients

275K

Employees Filed For

120+

ERC Advisors

TESTIMONIALS

These companies trust us, so should you.

What we'll do for you

We are ERC experts and have helped thousands of businesses. Don't worry, we can help make sense of it all. Our dedicated experts will handle the entire ERC process from beginning to end so you can maximize the ERC for your business.

Our Services Include:

Free one-on-one call with an ERC Expert Advisor

Thorough evaluation regarding your eligibility

Comprehensive analysis of your claim

Guidance on the claiming process and documentation

Specific program expertise that a regular CPA or payroll processor might not be well-versed in

Fast and smooth end-to-end process, from eligibility to claiming and receiving refunds

Dedicated ERC Specialists

Dedicated specialists that will interpret highly complex program rules and will be available to answer your questions, including:

How does the PPP loan factor into the ERC?

What are the differences between the 2020 and 2021 programs and how does it apply to your business?

Guidance on the claiming process and documentation

Specific program expertise that a regular CPA or payroll processor might not be well-versed in

Fast and smooth end-to-end process, from eligibility to claiming and receiving refunds

Dedicated ERC Specialists

Dedicated specialists that will interpret highly complex program rules and will be available to answer your questions, including:

How does the PPP loan factor into the ERC?

What are the differences between the 2020 and 2021 programs and how does it apply to your business?

Guidance on the claiming process and documentation

Specific program expertise that a regular CPA or payroll processor might not be well-versed in

Fast and smooth end-to-end process, from eligibility to claiming and receiving refunds

What we'll do for you

From small to large enterprise businesses, we handle it all.